If you're a cryptocurrency trader, you're likely familiar with the importance of identifying market trends and signals. However, with the constantly changing crypto landscape, staying on top of the latest trading signals and indicators can be challenging.

That's where CoinScreener's Unusual Activity Alerts come in.

How you can take advantage of Unusual Activity Alerts Features

Here's a step-by-step guide on how to effectively use CoinScreener's Unusual Activity Alerts to improve your trading strategy:

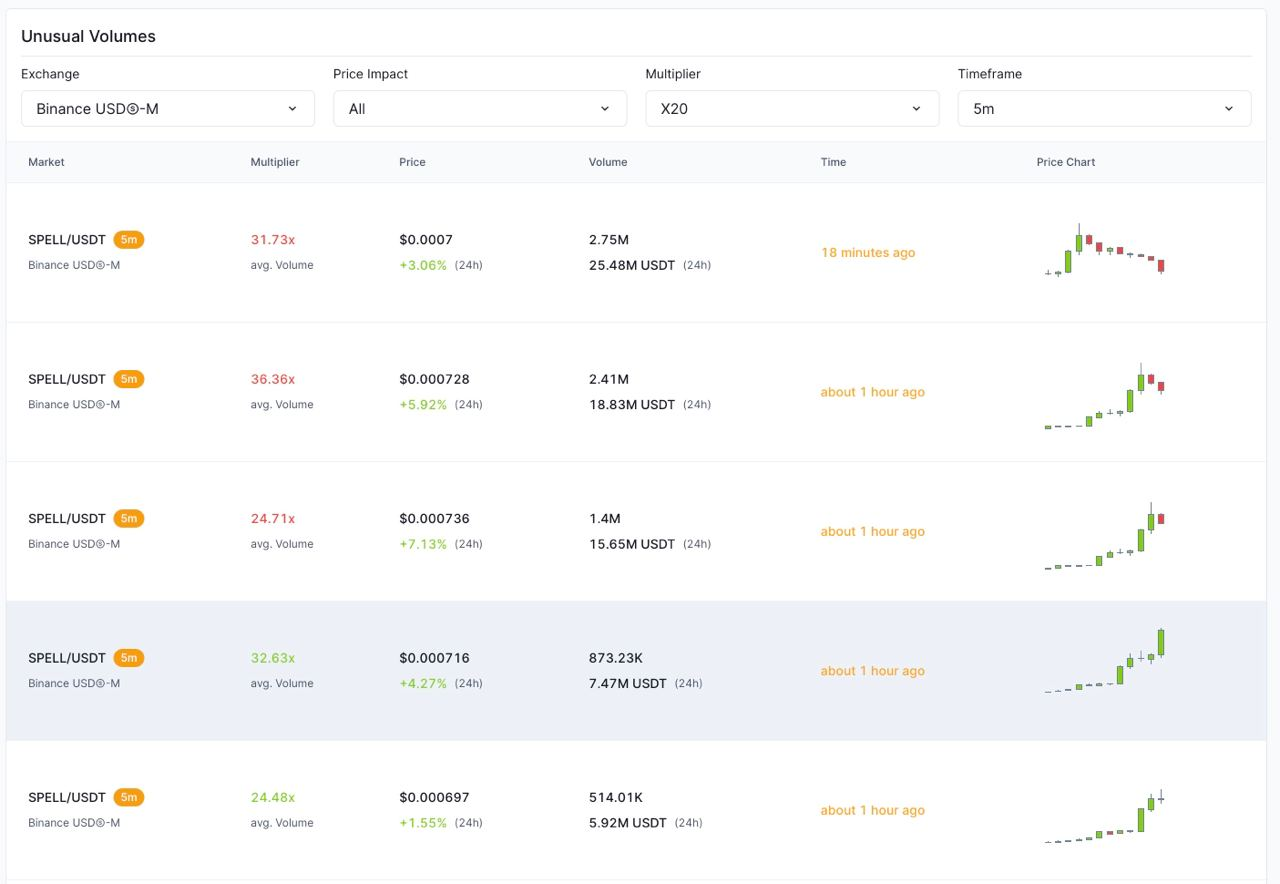

Step 1: On CoinScreener app/webapp, you will get Pump/Dump Unusual Volumes signals. Today, typical for a series of Pump Unusual Volumes 20x or more the volume of SPELL/USDT tokens, with a time frame of 5 minutes.

Step 2: Watch the signal closely and determine if the price range is heading towards the 4-hour supply zone, also known as the strong resistance area. If the price shows signs of going down (by using a lower timeframe such as 3m or 5m)=> It's time for a potential short, make sure to set your Stop Loss (SL) above the current high to minimize your risk.

Now, sit back and monitor your position. One of our users sent us a photo of his trade based on this strategy, with an ROI of 123% in just a matter of hours! Please note that you should not hold this type of trade for too long as the market can reverse easily and you lose your profit or even hit your stop loss. Target a R:R 1:1.4 or 1:2 to make sure you can achieve your profile. Happy trading!

By following this strategy, you can effectively short/long on pump/dump Altcoins and maximize your profits.

But remember, this approach is not suitable for coins with high market caps in the top 10-15. For those coins, you may want to follow the trend.

Conclusion

With Unusual Activity Alerts, CoinScreener provides real-time alerts on market pumps & dumps and unusual volume activities. Utilizing these alerts and signals lets you stay on top of the latest trading trends and maximize your profits.

Start using CoinScreener's Unusual Activity Alerts today and see how they can improve your trading results.

Wishing you all the best in effectively exploiting CoinScreener's trading tools!

Disclaimer: This is not financial advice. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk.