DISCLAIMER: This is not financial advice; the article is for educational purposes only.

If you’re looking to get involved in the cryptocurrency sphere, one of the first steps to consider is whether you will buy digital assets or speculate on their prices. Coinscreener is willing to share some valuable lessons that you can learn from Top traders and apply in your trading experience.

Who are Top Traders?

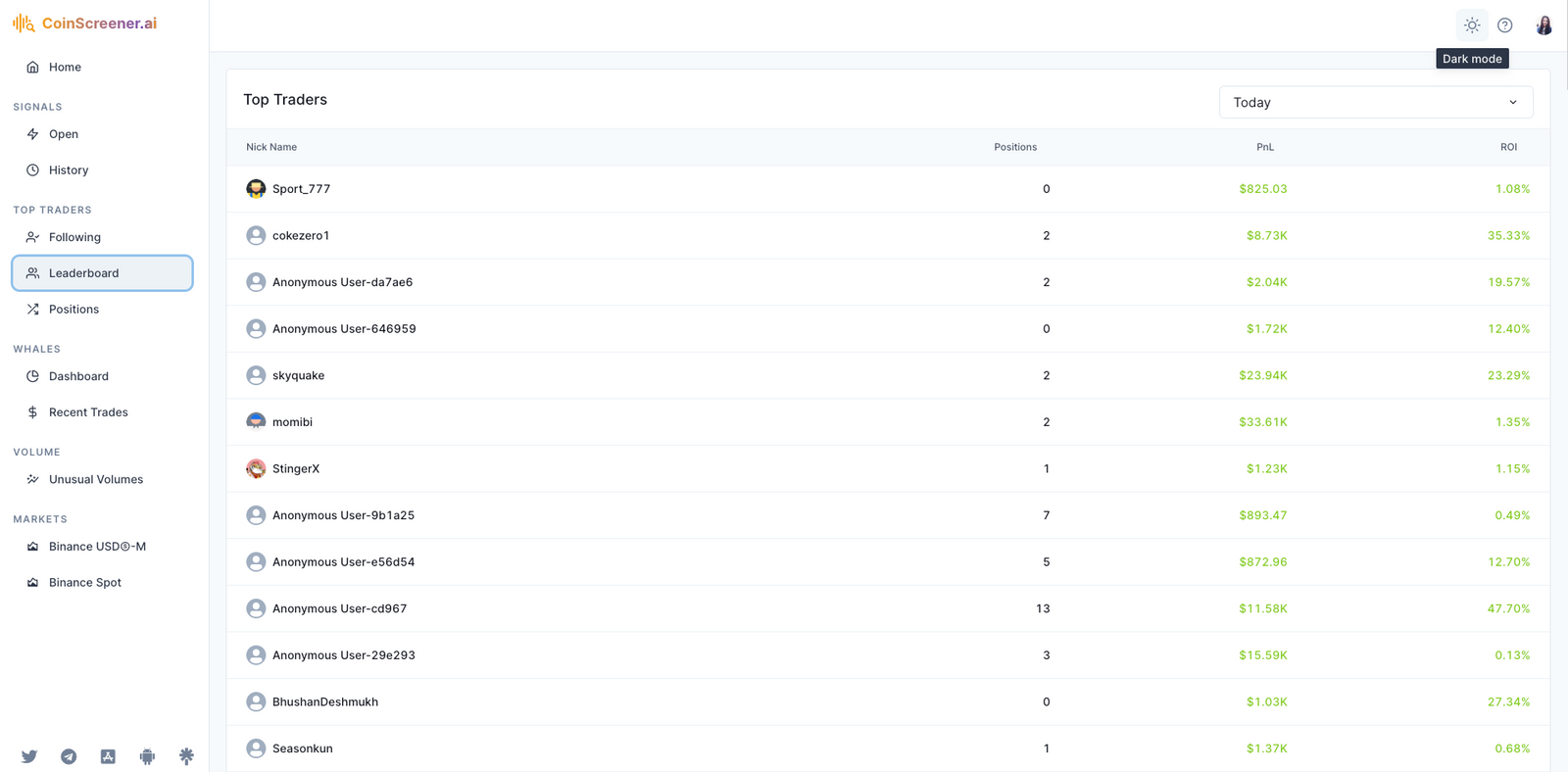

- Top Traders are the highest-performing leaders, based on their ROI (Return on investment) and PnL (Profit and Loss) within a given period of time.

- The leaderboard is the place for aspiring or experienced traders to refer to the other trader influencers and follow their trades orders potentially.

- The trader ranking list will be regularly updated by a given time, daily, weekly, monthly, yearly, and all-time PnL with their closed and current positions.

How to utilize Top Traders information on CoinScreener?

1. Follow top traders

Users can screen the Top traders with the highest PnL and ROI to analyze their behavior in trading. Some Top traders also make their Twitter profiles public for users to access and learn from their trading opinions.

Once following Top traders, users will get notified when they open/adjust/close their positions.

Disclaimer: Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Remember to observe the market before deciding to open any position.

2. See how Top traders deploy their trade orders

If users already have the coins they want to trade in mind, they can refer to how top traders are doing with this particular market to reinforce their decision.

2.1. Know when is the best time to buy and sell

Top traders mostly know that there are some periods when the market is more bearish or bullish or stable. Therefore, they focus on those 03 different types of change to make better buying and selling decisions. Also, the more information they have, the more accurate their trading decisions will be, so they stay up to date with all the news that may affect their trade position. However, Top traders also have a handle on their own psychology.

2.2. Learn that timing is everything

Top traders have to make lightning-fast decisions on whether to take a trade, keep a trade open, or close a trade—all while keeping an eye on the big picture of the market. Setting a stop loss too close or too far away from the entry point can lead to the difference between a win and a loss.

2.3. Understand the trading fundamentals

Top traders know how to read charts and spot opportunities to trade based on those fundamentals on how changes in interest rates, political situations, inflation rates, and debt all affect currency values.

2.4. Control on how to handle your own finance

Top traders understand that it's important to educate themselves on risk management, money management, and trading psychology to trading strategies and technical indicators. They understand profits and losses are part of the game. However, It's not about making money, but about keeping the money you make.

2.5. Know how to trade and keep it small and simple.

Top traders will have specific strategies by sticking to a few rules and having a clear idea of what they expect from each trade order. They will build on the basics slowly over time.

TAKEAWAY - 10 rules followed by Top Traders

- Always set stop loss

- Do not cut corners

- Avoid the obvious

- Use tools that fit well your trading plan

- Watch for alerts

- Stick to your discipline

- Embrace simplicity

- Risk only what you can afford

- Treat trading like your business

- Develop trading methodology based on facts

Related: What are Trading Signals? How to find Trading Signals with CoinScreener?

Conclusion:

In conclusion, the best way to learn is to practice, practice, practice. You must be patient because it takes time to build up knowledge and experience. Keep following Coinscreener's blog, and we'll tell you more about the ins and outs of Crypto trading.

Please let us know how we can help you by leaving a comment below. Coinscreener appreciates your feedback.

Follow CoinScreener: https://linktr.ee/coinscreener.ai