The crypto market is not a place for amateur traders. In the financial markets, not everyone has the skills necessary for technical analysis and developing profitable trading methods. It's because of this reason that traders seek out trading signal providers.

For that matter, what is a trading signal, and how does it function in the trading process? Let's find out in this article!

What is a Trading Signal?

The trading signal is an actionable suggestion to buy or sell an asset, specifically in our case, cryptocurrency, generated by analysis. They tend to be associated with quick and, most of the time, successful completion of a transaction.

They tell you exactly the instrument, entry price, the expected take profit targets, risk:reward ratio, and the stop loss.

Each of the cryptocurrency trading signals came with a calculated risk factor, which is calculated by algorithms (it is a mathematical result based on volatility, volume, market, correlation,…). If this level exceeds specific numbers, crypto trading signals won’t be shared with the community to avoid unnecessary risks.

How a Trade Signal Works

Trade signals can use a variety of inputs from several disciplines. Typically, technical analysis is a major component, but fundamental analysis, quantitative analysis, and economics or news may also be inputs, as well as sentiment measures and even signals from other trade signal systems.

The goal is to give investors and traders a mechanical method, devoid of emotion, to buy or sell a security or other asset.

Aside from simple buy and sell triggers, trade signals can also be used to modify a portfolio by determining when it might be a good time to buy more or a bad time to stop the loss of one particular cryptocurrency. Meanwhile, could have signals for adjusting the duration of their portfolios by selling one maturity and buying a different maturity.

Where do trading signals come from?

The three most common sources of trading signals are:

Chart: Charts and indicators give you active trading signals.

Trader: Signals offered by seasoned professionals with a track record of success. That person may be the trading group's administrator or a technical analysis expert. A fee is typically charged by experts for their advice. However, there are credible, no-cost signal sources available as well.

Related: Top Traders - What will you learn from them?

Bot Signal: A signal provided by a pre-programmed computer (bot). The advantage of the bot signal is that it works 24/7, tracking many trading pairs at the same time, has profit statistics, and is not affected by crowd psychology. The disadvantage of the bot is that the signal does not capture the news, and the trading strategy may not be right at a certain stage of the market.

How to find Trading Signals?

Trading signals on CoinScreener are generated by advanced technical analysis and AI algorithms.

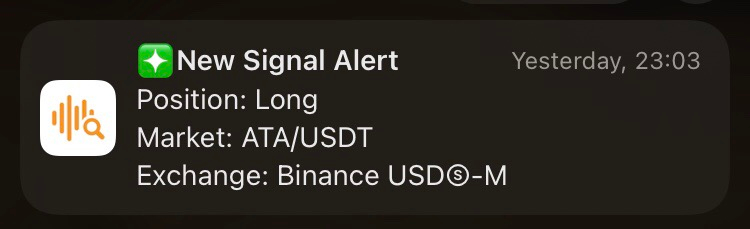

Example Binance exchange trading signals (Notification on Coinscreener app)

Example Signals interface in CoinScreener App

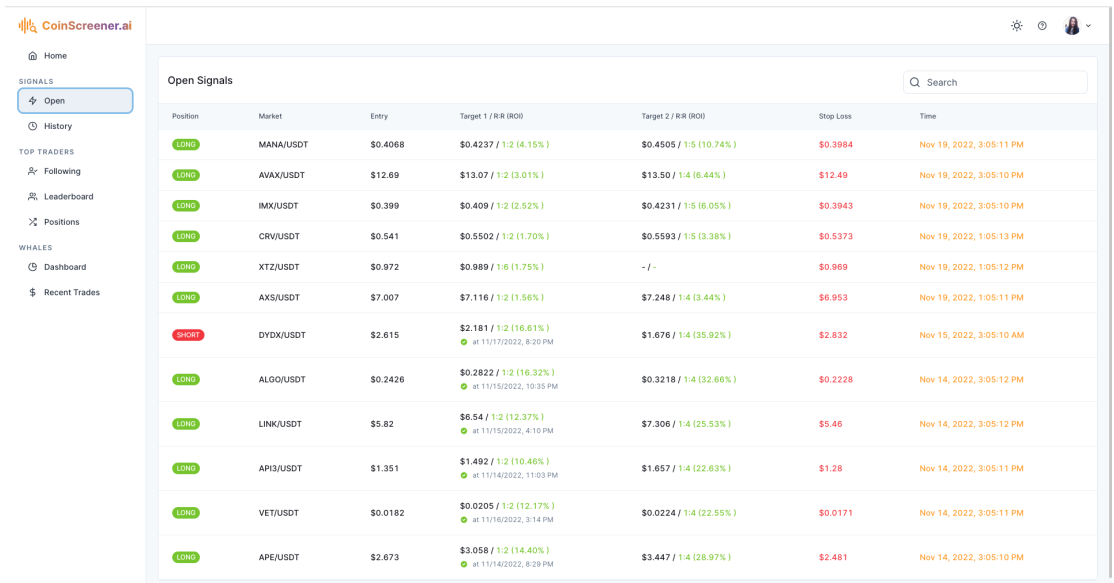

Example Signals interface in CoinScreener WebApp

When user logs in and navigates Open Signals from the left side navigation, open signals will be displayed in a table on the right screen, with the following information:

● Positions (Long/Short)

● Market

● Entry price

● Target 1

○ Target Price.

○ Target Risk: Reward ratio (R:R)

○ Target Return on Investment (ROI)

● Target 2

○ Target Price.

○ Target Risk: Reward ratio (R:R)

○ Target Return on Investment (ROI)

● Stop Loss price.

How to use Trading Signals from CoinScreener?

1. Get the trading signals alert on CoinScreener Platform

CoinScreener's Signal Bot is available on both the web app and iOS app. Links are below:

- Webapp

- iOS app

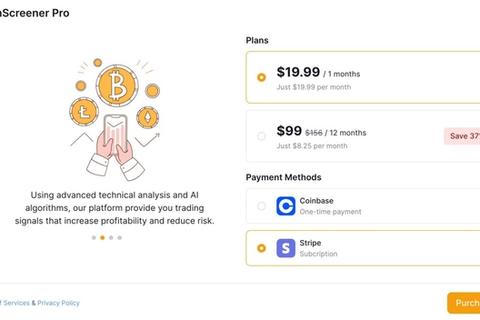

It is a function exclusively for traders who have knowledge of margin as well as trading and have upgraded to the "Pro" plan.

To upgrade your account, you just need to register a Coinscreener account and unlock "Pro"

2. Go to the cryptocurrency exchange where you have an account. Some exchanges might require KYC approval in order for you to start trading futures

3. Make sure that you have funds in your exchange account

4. Check open signals provided on CoinScreener.ai and choose a signal you want to follow.

Signals are notified in the form of a popup message on mobile phones, including all necessary information for traders to enter orders: Market, Entry, Leverage, TP, SL.

5. Go to the cryptocurrency futures exchange and select the market of the signal you chose

6. On the trading page, you should find the Order Form

7. On the Order Form, you need to key in the details of the crypto signals from CoinScreener.ai. We advise you to trade with a reasonable amount depending on your risk tolerance.

Once you place the order, your order will remain in the Open Orders blotter and be executed when the entry price is hit. The position will execute a take profit as the signal. Otherwise, the stop loss will prevent further losses.

Benefits of trading signals from CoinScreener

- The signal running 24/7 always ensures a stable signal.

- Exclude traders' emotions, does not notify many alerts when the market enters a losing streak, or FOMO when entering a winning streak.

- The bot is always improved daily through advanced technical analysis & AI algorithms

- The signals are system-generated, running to reach your targets, just to maximize your trading opportunities.

- Trading Signals cost a fee, you to sign up for an account and unlock the “Pro” Plan and following the above steps.

Conclusion

Trading signals play an important role in trading, especially for traders that rely largely on technical analysis for their Crypto transactions.

Signal not only gives traders signals to trade but also gives traders more confidence. A lot of people join channels/app/website that provides trading signals only for their own reference and strategy.

Trading signals in general are like information. Can be provided for free or for a fee. But in the end, the decision to enter the order still lies with you.

Please let us know how we can help you by leaving a comment below. Coinscreener appreciates your feedback.

Our favorite quotes

“Yesterday’s home runs don’t win today’s games.”

– Babe Ruth

“Risk comes from not knowing what you’re doing.”

– Warren Buffett

Experience the power of AI for trading on CoinScreener through get the latest insights and trading signals, following top traders, and tracking the history of whale activities for 1000+ Future & Spot markets today and start optimizing your profits.

Follow CoinScreener: https://linktr.ee/coinscreener.ai

#coinscreener #coin #screener #coinscreener.ai #crypto #ai #cryptosignals #cryptocoin #token #cryptoscreener #screenerapp #screenertool #tradingsignals #aitradingsignals #technicalanalysisscreener #technicalanalysis #tradingbot #cryptohopper #cryptobot #dcabot #robot #calculatorcrypto #btc #binance #liquidations #fundingrate

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of CoinScreener. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.