What is a Trailing Stop Order?

A trailing stop order allows traders to place a pre-set order at a specific percentage away from the market price when the market swings. It helps traders limit losses and protect gains when a trade does not move in the direction traders consider favorable.

The trailing stop moves by a specified percentage when the price moves favorably. It locks in profit by enabling a trade to remain open and continue to profit as long as the price is moving in a direction favorable to traders. The trailing stop does not move back in the other direction. When the price moves in the opposite direction by a specified percentage, the trailing stop will close/exit the trade at market price.

How does a Trailing Stop Order work?

Traders can place a trailing stop order when entering a position initially, though this is not a typical move. The trailing stop could also be recognized as a reduce-only order with the aim to decrease or close an open position.

For a long trade, a “sell” trailing stop order would be placed above the latest transaction price. When the price moves up, the trailing stop price moves up by a specific trailing percentage, eventually forming a new trailing stop price. When the price moves down, the trailing stop also stops moving. A sell order will be issued if the price moves more than the predetermined callback rate from its peak price and reaches the trailing stop price. The trade will close with the sell order at the market price.

A ”buy" trailing stop order is the opposite of a “sell” trailing stop order.

For a short trade, a “buy” trailing stop order would be placed below the latest transaction price. When the price moves down, the trailing stop price moves down by a specific trailing percentage, eventually forming a new trailing stop price. When the price moves up, the trailing stop also stops moving. A buy order will be issued if the price moves more than the predetermined callback rate from its lowest price and reaches the trailing stop price. The trade will close with the buy order at the market price.

Please note that both conditions (activation price and callback rate) need to be fulfilled in order to activate the trailing stop order to close/exit as a market order.

Difference Between Trailing Stop Order and Stop Loss Order

1. A stop loss order helps to reduce losses, while a trailing stop order locks in profit and limits loss at the same time.

2. A stop loss order is fixed and has to be manually reset, while a trailing stop is more flexible and automatically tracks the price direction.

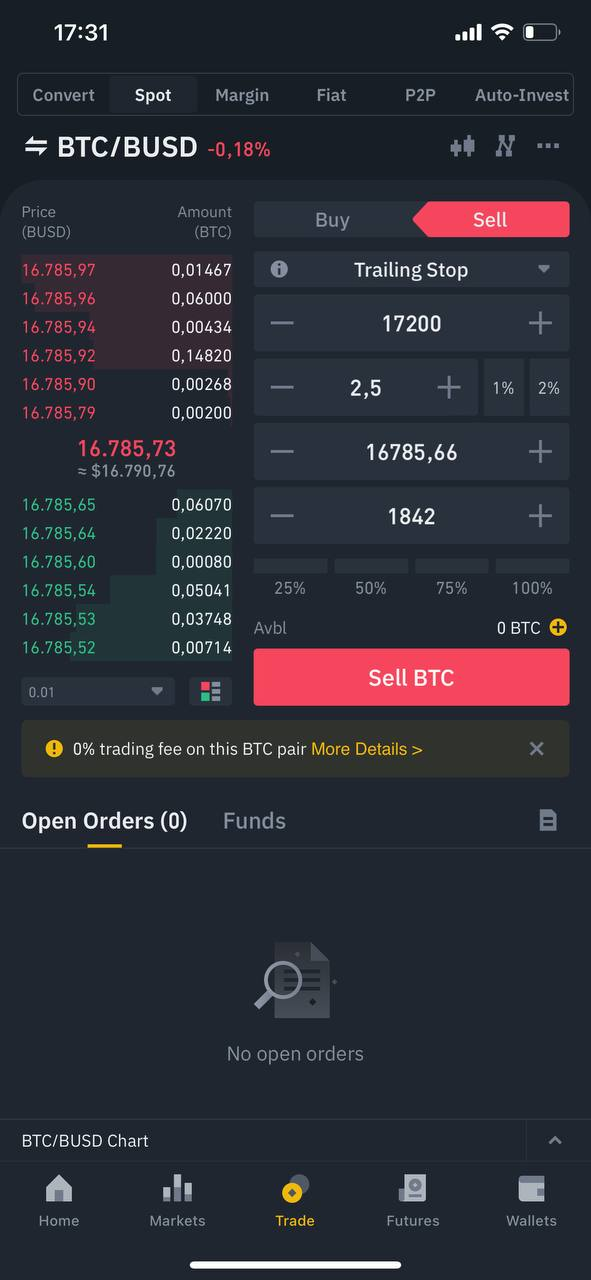

How to Place a Trailing Stop Order on Binance?

To activate a trailing stop order, 2 conditions need to be fulfilled.

A buy trailing stop order will be placed if the following conditions are met:

- Activation Price ≥ Lowest Price

- Rebound Rate ≥ Callback Rate

A sell trailing stop order will be placed if the following conditions are met:

- Activation Price ≤ Highest Price

- Rebound Rate ≥ Callback Rate

1. Callback Rate

The callback rate is the percentage of movement in the opposite direction that you are willing to tolerate. The callback rate ranges from 0.1% to 5% and users can enter this rate manually in the “Callback Rate” field. Alternatively, there are preset options such as “1%” or “2%”for quick selection.

2. Activation Price

The activation price is your desired price level that triggers the trailing stop.

To place a buy trailing stop order, the activation price must be set lower than the current market price. Conversely, the activation price must be higher than the current market price for a sell trailing order.

The market's highest/lowest price must reach or exceed the activation price in order to meet the condition.

3. Types of Trigger

You can choose either “Last Price” or “Mark Price” as a trigger. If “Mark Price” is selected, the trailing stop order will be activated when the Mark Price reaches or even though the Last Price has not reached the activation price.

Please note that Binance uses Mark Price as a trigger for liquidation and to measure unrealized profit and loss. The Mark Price is generally similar to the Last Price, but the Last Price might deviate dramatically and significantly from the Mark Price during extreme price movements. Hence, please monitor the price difference between the Last Price and the Mark Price. You can always cancel the order you placed, or replace the order if you would like to change the trigger from Mark Price to Last Price and vice versa.

Source: Binance

For Example:

(1) If BTC reaches $17,200 and drops below the line of $17,000, there will be a Short position here.

(2) We will place a “Sell” Trailing Stop Order for a short trade.

The order trigger price is 17200 and when the price drops to 2.5% of 17200 is 430

Entering the command will automatically activate when BTC up 17200 is 17200-430= 16790

We will entry up 3,000USD x 10 at $16790.

Important Notes

Setting an optimal callback rate and activation price could be a daunting process.

For a trailing stop to be effective, a callback rate should neither be too small or too large and the activation price should neither be too close or far away from the current price. When the callback rate is too small or the activation price is too close, the trailing stop is too close to the entry price and is easily triggered by normal daily market movements. There is no room for a trade to move in a direction favorable to traders before any meaningful price moves occur. The trade will close/exit at a point where the market took a temporary dip and then recovered, resulting in a losing trade.

When the callback rate is too large, the trailing stop will be only triggered by extreme market movements, which means the traders are taking on unnecessarily large risks.A higher callback rate is generally a better bet during volatile periods, while a lower callback rate is preferable during normal market conditions.

There is no ideal optimal callback rate and activation price. Traders are advised to revise their trailing stop strategy from time to time due to constant price fluctuations in the market.

You should always carefully consider whether a trade is consistent with your risk tolerance, investment experience, financial situation and other considerations that may be relevant to you. Other than the range of price changes, always determine your callback rate and activation price based on your targeted profitability levels and acceptable losses within your capacity.

Related: Why should you pay attention to Crypto Whales?

CoinScreener hopes that this information will help you become an informed cryptocurrency trader. For related academic articles: Click here.

Follow CoinScreener: https://linktr.ee/coinscreener.ai

#coinscreener #coin #screener #coinscreener.ai #crypto #ai #cryptosignals #cryptocoin #token #cryptoscreener #screenerapp #screenertool #tradingsignals #aitradingsignals #technicalanalysisscreener #technicalanalysis #tradingbot #cryptohopper #cryptobot #dcabot #robot #calculatorcrypto #btc #binance #liquidations #fundingrate

DISCLAIMER

CoinScreener strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.