In the cryptocurrency market, the participants are extremely diverse, from small investors to large-scale institutional investors. If for other financial markets, we don't feel their presence clearly, for cryptocurrency, we can easily look up the trend of their asset movement through on- chain.

Then what exactly are whales and sharks? In the article, we will answer this question and analyze the ways in which they have their hands on the cryptocurrency market.

Who are Crypto Whales?

Individuals or organizations that hold at least 10% of the circulating supply of a given cryptocurrency or have the funds to make astronomical purchases. Some of the most giant crypto whales include CEO, owners, and founders of various crypto projects or businesses.

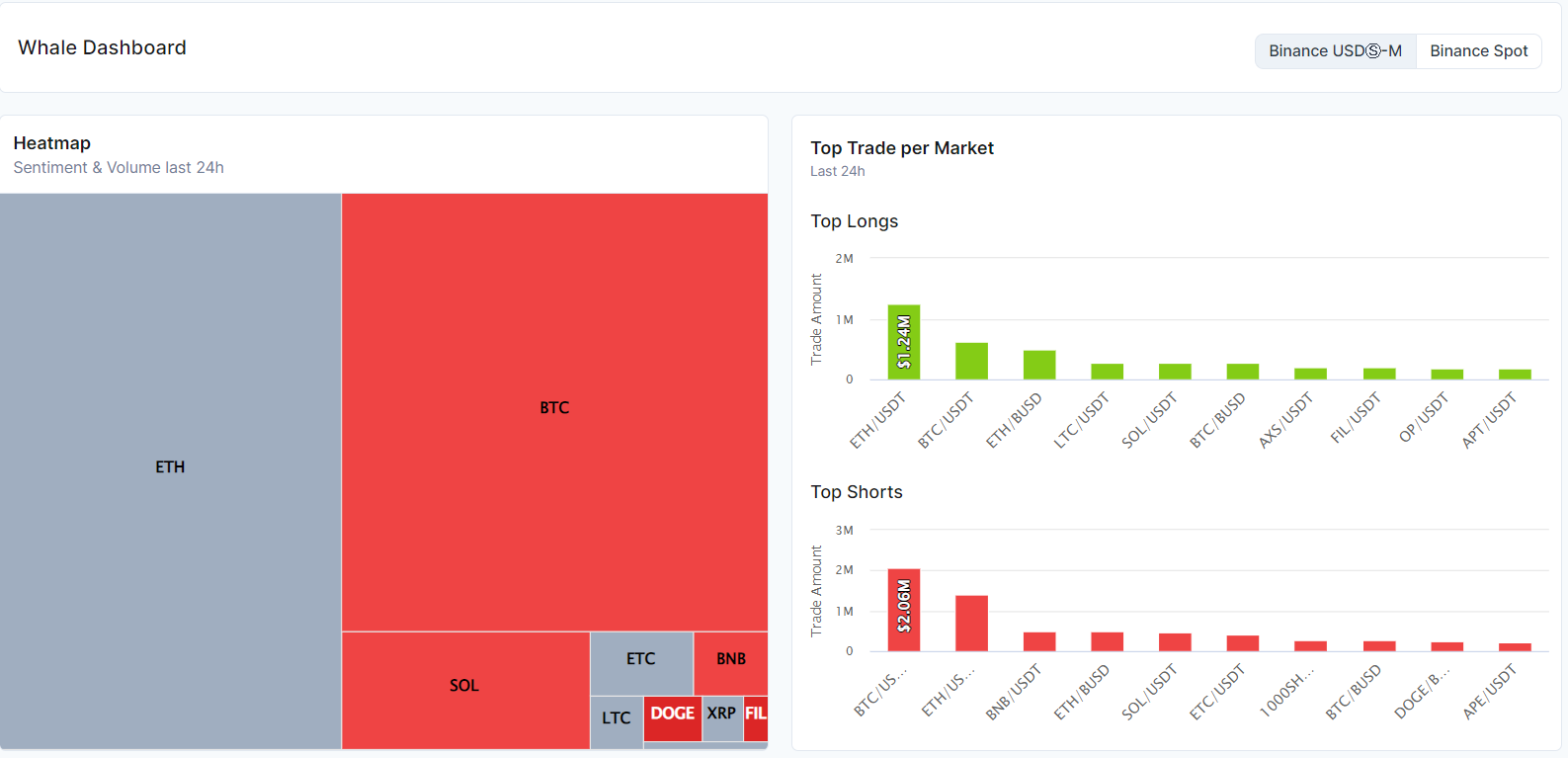

On CoinScreener, we categorize whales as follows:

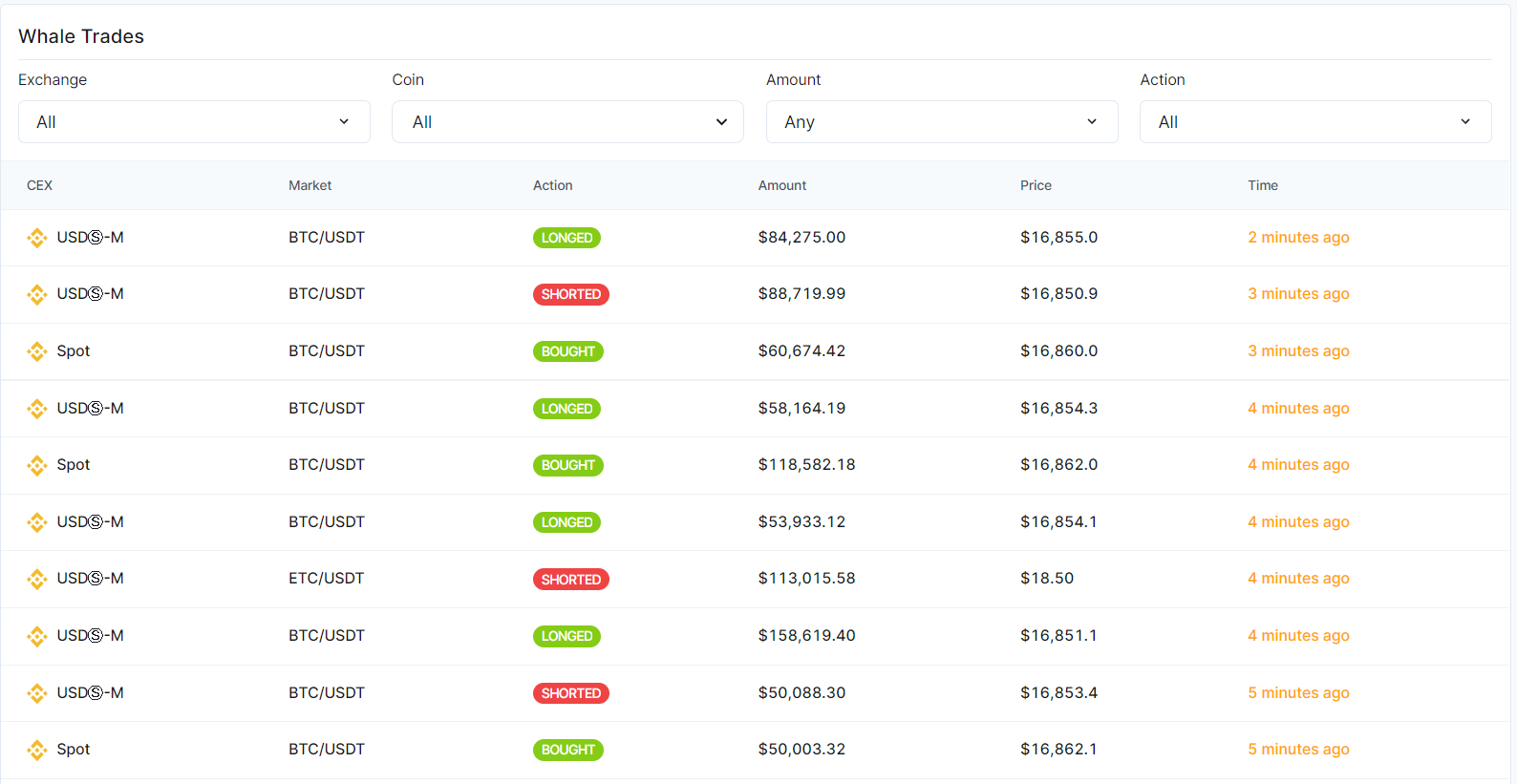

- Future: transaction amount is greater than or equal to $50k

- Spot BTC and ETH: transaction amount is greater than or equal to $50k

- Spot Alt Coins: transaction amount is greater than or equal to $25k

Why you should pay attention to Crypto Whales

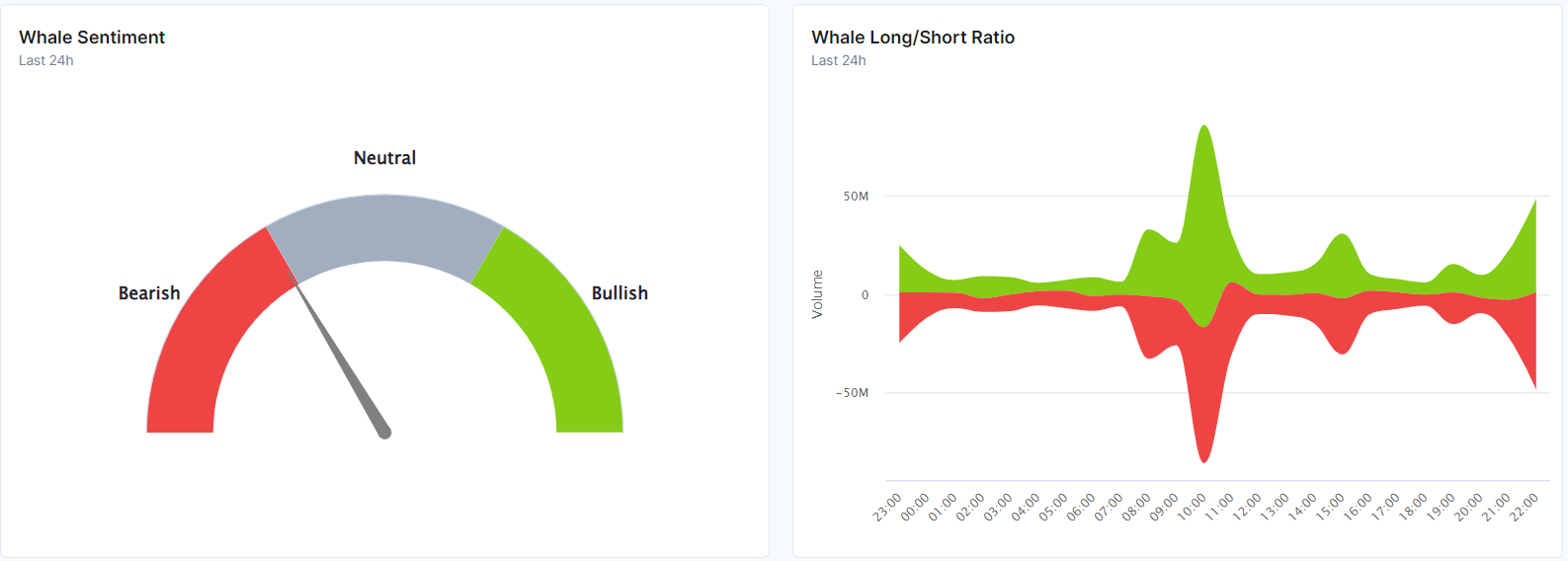

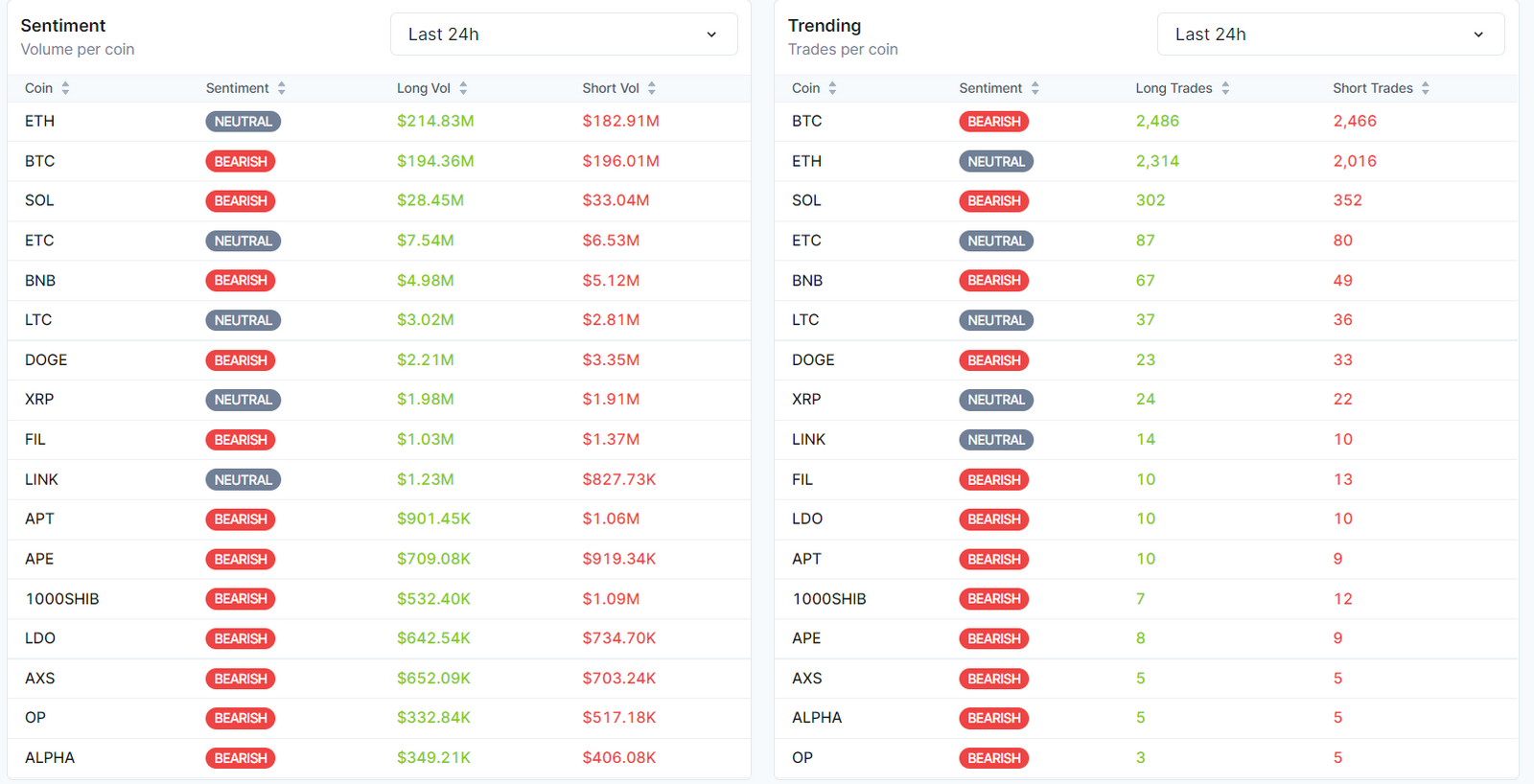

Whales increase balance, more whales = Bullish

Whales decrease balance, fewer whales = Bearish

Whale's effect on liquidity

Liquidity refers to the ability of an asset to be bought or quickly at a fair price.

Because whales own high-profile wallets, they can be a problem for cryptocurrency because of the concentration of wealth, particularly if it sits unmoved in an account. When coins sit in an account rather than being used, it lowers that specific cryptocurrency's liquidity because fewer coins are available.

Whale's effect on the price

If whales buy large amounts of particular crypto, its price is bound to increase. This is because when a whale buys in bulk, it creates scarcity, triggering a price rally.

On the flip side, if they dump a token in large quantities, which leads to supply increases dramatically, and causes a price plunge.

When whales place large buy or sell orders and there's not enough liquidity in the market to fill their order, it can cause prices to move sharply in one direction or the other.

Example: February 2021 observed the volatility of ETH on Kraken from nearly $1,600 to $700, which could result from a single whale selling their holdings, according to the exchange's CEO.

What you should do if you are notified of whale's transaction by CoinScreener

With CoinScreener's advanced technical analysis and AI-generated signals, you can take your crypto trading to the next level with confidence by tracking whale activities for 1000+ markets.

Keep an eye on the market and never miss an opportunity. You will get alerted of large buys/sells and track the history of whale activities for 1000+ Future & Spot markets with CoinScreener.

Observe what's happening and try to understand the motives behind the whale's action. Once you have a better understanding of the situation, you can then decide whether or not to make a trade.

Related: What are Trading Signals? How to find Trading Signals with CoinScreener?

Conclusion

Determining the movement trend of "whales" is extremely important to help preserve capital as well as increase individual wealth.

However, on the market today, there are too many “noise” tools and indicators to distract to get money from the majority. Therefore, it is necessary to carefully analyze the information that you receive in order to avoid being deceived in the market.

DISCLAIMER: This is not financial advice; the article is for educational purposes only.