Crypto technical analysis predicts future trends using mathematical indications based on price action data. Markets follow patterns and once established, trends tend to persist.

Investors typically purchase low and sell high to profit. Technical analysis can help uncover cheap prices before establishing a trade.

Crypto technical analysis has many methods. Each trader prefers different indicators and interprets them differently. Crypto technical analysis, like stock technical analysis, does not guarantee performance.

Crypto Technical Analysis: The Basics

You can utilize a wide variety of chart patterns and technical indicators for crypto technical analysis.

CoinScreener.ai will show you several technical indicators for technical analysis in this article.

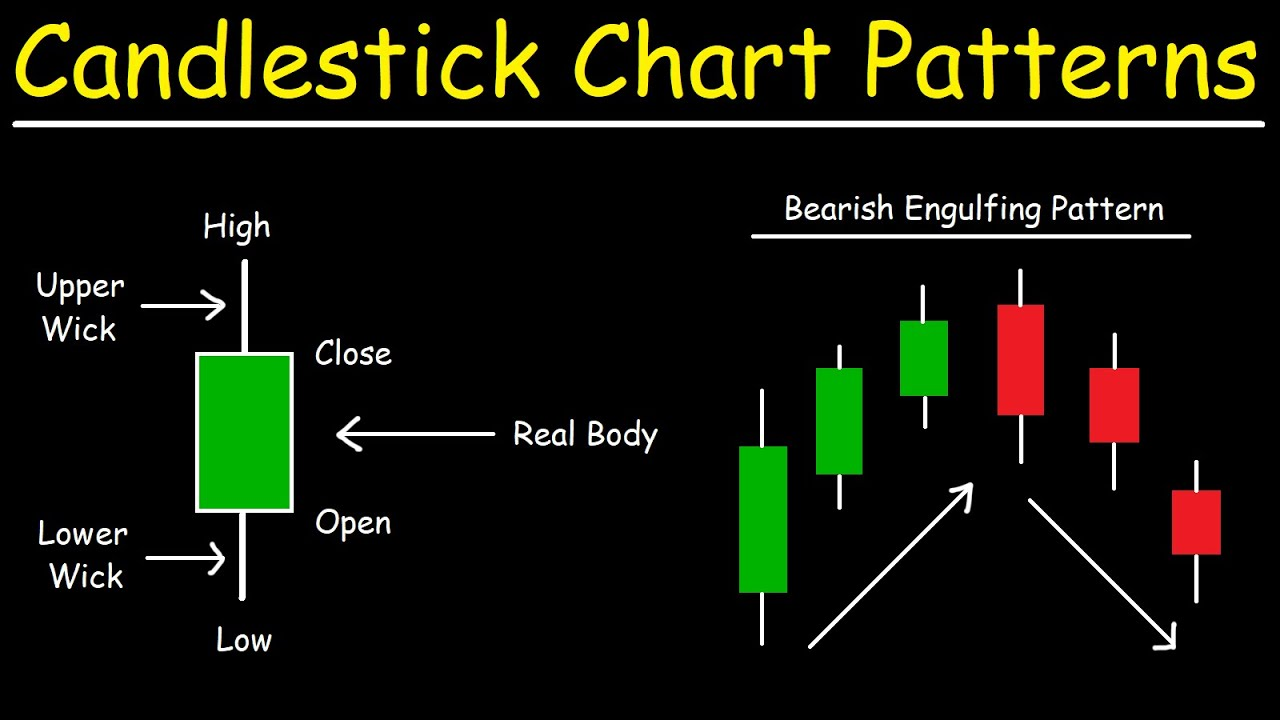

Candlestick Charts

Candlestick charts' detail appeals to traders. Candlesticks show four price levels at each interval instead of one point. (Visually, from top to bottom):

• High price

• Opening price

• Closing price

• Low price

A bar and two wicks indicate this on candlesticks. The top and bottom wicks represent high and low prices, respectively.

Candlesticks can be green or red. Green means prices rose, and red means they fell.

Green candlesticks show closing and opening prices. Red candlesticks show opening and closing prices.

Each candlestick shows how investors are buying and selling bitcoin at a given time when read in context.

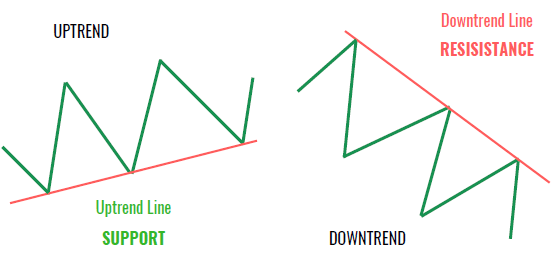

Support and Resistance Levels

Prices typically bottom or peak at support and resistance levels. These levels may help traders make decisions.

What determines support and resistance? Many methods. A chart might show where prices have frequently pulled back (resistance) or bottomed out (support) (in the case of support).

These price levels may influence traders' strategies. Stop-loss orders are put at support, while sell orders to take profits are placed above resistance.

Support and resistance can be used to predict price reversals or signal a new trend if prices break through them. Prices above resistance may suggest continued upside momentum. If prices fall below support, they may fall further.

Relative Strength Index (RSI)

Veteran and newbie traders love the Relative Strength Index. Line graphs below price charts show this indicator.

The line oscillates between 0 and 100, with 50 neutral. A larger score indicates overbuying, whereas a lower value indicates overselling.

RSI, like many technical analysis tools, works best with other indicators. If cryptocurrency prices were reaching a well-established support level and the RSI was low at 20, the odds of a price rally were higher than usual.

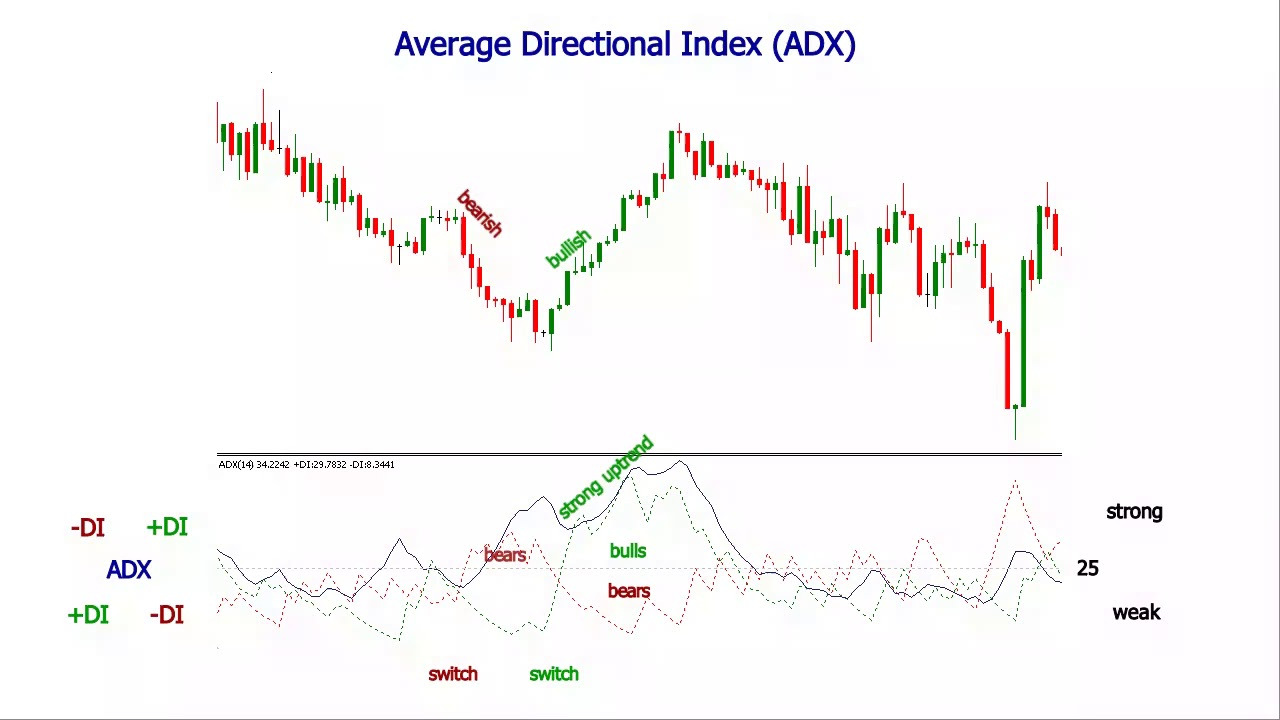

Average Directional Index (ADX)

Short-term indicators like the average directional index help investors assess trend strength. Trend momentum may increase as ADX rises.

ADX is the average of directional movement lines over time. These lines use current low and high prices. ADX, like RSI, ranges from 0 to 100.

ADX rarely exceeds 60, unlike many other indicators. Chart analysts say an ADX of 25 or higher shows trend strength and a reading below 20 suggests no trend. Neutral is 20–25.

Rising ADX indicates a stronger trend.

Moving Averages (MAs)

Moving averages assist investors to detect trend direction, while the ADX measures trend strength. A moving average averages cryptocurrency data over a period by dividing the total by the number of data points. The "moving" average is updated with the newest price data, hence the name.

More data makes long-term moving averages better indicators. Short-term MA tracking is possible.

Moving averages have many forms, period lengths, and approaches to indicate trend direction.

MA-based bullish setups include the "golden cross." The 50-day MA above the 200-day MA is a common example of this.

Trend Lines

Trend lines show potential trends. Multiple trend lines on the same chart might illustrate more complex patterns.

Trend lines are simple lines linking high and low price points. More points on a line may indicate a greater trend.

Trend lines illustrate crypto technical analysis settings.

Cup and Handle Pattern

The bullish cup-and-handle pattern is well-known. It's a price chart with a cup (the bottom half of a circle) and handle (a downward-slanting line at about a 45-degree angle).

Prices must fall, momentarily trade sideways, increase for the same amount of time as they plummeted, and then drop sharply. The final drop forms the handle, confirming the pattern and raising prices.

The opposite pattern is bearish. An upside-down cup and handle could lower prices.

Conclusion:

Technical analysis is one of several things investors should know before investing in crypto. Despite using mathematical indications, cryptocurrency technical analysis is subjective.

No technical indicator is perfect. Prices may behave differently even when many indicators agree. A trader can hope for a better likelihood of making a wise selection based on available information.

Interested in trading crypto? With CoinScreener's advanced technical analysis and AI-generated signals, rich data source from more than 1000 Future & Spot markets enriched by Machine Learning, and major cryptocurrency exchanges in the world to screen for market trading signals, monitor and analyze the trading behavior of Whales, Top Traders to identify the best market trends in real-time and make the most profit from your trade today.

Follow CoinScreener: https://linktr.ee/coinscreener.ai

#coinscreener #coin #screener #coinscreener.ai #crypto #ai #cryptosignals #cryptocoin #token #cryptoscreener #screenerapp #screenertool #tradingsignals #aitradingsignals #technicalanalysisscreener #technicalanalysis #tradingbot #cryptohopper #cryptobot #dcabot #robot #calculatorcrypto #btc #binance #liquidations #fundingrate